Introducing the ASHIK Strategy: A Conservative Approach to Banking Stocks with Built-in Protection.

Investing in stocks can be rewarding but also risky. That's where our unique ASHIK strategy comes in. It's designed to handle a portfolio of banking stocks, while minimizing exposure to market risk. The ASHIK strategy is conservative and suitable for those who want to grow their investment while keeping it secure.

- 1. What Is the ASHIK Strategy?

The ASHIK strategy is a method of investing in banking stocks. But what sets it apart is its use of a 'butterfly hedge' for protection. Here's how it works:

Investing in Banking Stocks: You'll invest in a carefully selected group of banking stocks.

Using the Butterfly Hedge: This is where the protection comes in. A butterfly hedge is a particular combination of buying and selling options that helps to limit your potential losses. It's like an insurance policy for your investment. - 2. How Does the Butterfly Hedge Work?

The butterfly hedge is a bit complex, but the essential idea is that it allows you to set a range for your potential profits and losses. By using different options, it ensures that:

If the banking stocks do well, you'll make a profit, but it might be capped at a certain point.

If the banking stocks do poorly, your losses are also limited, providing you with protection.

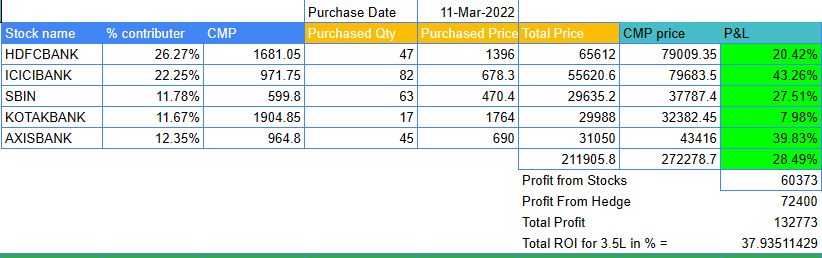

- 3. Past Performance and Drawdown

In the past, the maximum loss (or drawdown) with this strategy has been negligible. It means that the protection from the butterfly hedge has effectively worked to minimize losses.

- 4. Expected Returns

You can expect a yearly return of 30 to 50% using this strategy. These returns are considerable, especially considering the limited risk involved.

- 5. How Much Do You Need to Invest?

You'll need 1.5 lakhs(150,000 in your currency) for each 'lot' or group of stocks and options you wish to trade. Starting with at least 2 lots is recommended.

- 6. Who Is This For?

This strategy is ideal for investors looking for a more conservative approach to the banking sector. It may suit those who want growth but with added safety measures.

- 7. Performance Information

For detailed performance statistics and examples, please visit this link.

Final Thoughts

The ASHIK strategy offers a unique blend of growth potential and risk management. If you're interested in banking stocks and want a method that incorporates protection, this approach might be worth considering.

Please remember, investing involves risks, and it's always advisable to consult with a financial professional to ensure any strategy aligns with your financial goals and risk tolerance.

Till 2023-08-06

Join the Telegram channel to get daily PnL updates

Contact us via WhatsApp at +91-70122 61556 to know more...