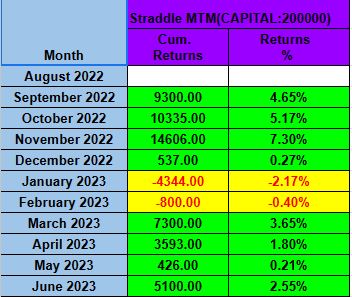

Introducing the Straddle MTM Strategy: A Comprehensive Approach to Options Trading

Options trading offers various strategies to match market behavior and individual risk tolerance. The Straddle MTM Strategy is a nuanced approach that builds on the principles of the Short Straddle but implements a combined loss threshold.

Here's a guide to this strategy:

- 1. Understanding the Market's Behavior

Range Bound vs. Trending: Similar to the Short Straddle, this strategy takes advantage of the market staying within a specific range about 70% of the time.

Utilizing Combined Loss Threshold: Unlike the Short Straddle, which sets individual stop losses for each leg, Straddle MTM employs a combined loss threshold for both legs. 2. What Is the Straddle MTM Strategy?

This strategy involves selling (shorting) both Call and Put options at the same strike price (ATM), but with a key difference in how losses are managed. Instead of setting separate stop losses for each leg, a combined threshold is used.3. How Does It Work?

Selling Options: As with the Short Straddle, you sell one lot of ATM options with weekly expiry at 9:20 am daily.

Setting a Combined Loss Threshold: You determine a combined loss level for both the Call and Put options. If this combined loss is reached, both options are exited.

Example: If the combined loss threshold is Rs.1000, and the sum of losses from both the Call and Put options reaches this level, you exit both legs.4. Why Does This Strategy Work?

Unified Loss Management: By considering the combined loss from both legs, this strategy allows for a more holistic view of risk and can offer different risk-reward dynamics.

Profiting on Range-Bound Days: As with the Short Straddle, you can profit from premium decay on range-bound days.

Controlling Risk on Wild Days: The combined loss threshold helps manage risk on days when the market moves significantly.

5. Who Is This For?

This strategy might be suitable for options traders who prefer a combined view of risk across both legs, rather than managing each leg separately.6. A Word of Caution

The Straddle MTM Strategy requires careful monitoring and a clear understanding of the combined loss dynamics. It involves risks that must be weighed against potential rewards.7. Final Thoughts

The Straddle MTM Strategy is a unique approach that builds on the principles of Short Straddle but offers a different risk management perspective. It may suit traders looking for a more unified way to manage their options positions.As with all investment strategies, it is essential to consult with a financial professional to ensure that this approach aligns with your specific financial goals and risk tolerance.